The Extraordinary and Expensive World of Space Insurance

The world of space-related insurance is characterized by audacity, innovation, and staggering financial stakes.

Throughout history, numerous instances have emerged that redefine our understanding of the risks and financial protection associated with space exploration. From the ingenious insurance covers of the Apollo 11 astronauts to the modern-day private spaceflight era led by companies like SpaceX and Blue Origin, the realm of space insurance has witnessed remarkable developments.

We’re delving into the realm of space insurance to explore some of the most extraordinary and expensive policies ever written:

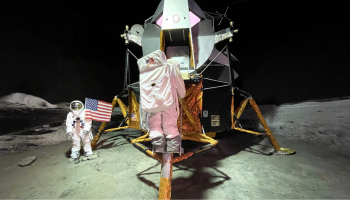

The Ingenious Insurance of Apollo 11

The tale begins in 1969 with the epoch-defining Apollo 11 mission, an expedition replete with risk, excitement, and uncertainties. The astronauts themselves, with their unconventional ‘insurance covers’ – autographed postal covers that their families could sell in case of an unfortunate event – challenged our traditional perception of insurance. These postal covers, although not a formal insurance policy, were an ingenious method of financial protection, showing the innovative spirit that pervades space exploration.

The tale begins in 1969 with the epoch-defining Apollo 11 mission, an expedition replete with risk, excitement, and uncertainties. The astronauts themselves, with their unconventional ‘insurance covers’ – autographed postal covers that their families could sell in case of an unfortunate event – challenged our traditional perception of insurance. These postal covers, although not a formal insurance policy, were an ingenious method of financial protection, showing the innovative spirit that pervades space exploration.

The Human Element: Armstrong and Aldrin’s Lunar Leap

Beyond tangible assets, insurers have also had to consider the human element of space travel. Neil Armstrong and Buzz Aldrin’s monumental moon landing in 1969 wasn’t just a historical moment; it was also a landmark for insurance. The astronauts secured their families’ futures through an unconventional method – autographed envelopes, known as ‘Apollo Insurance Covers’, that would be sold in case their mission ended in tragedy.

Beyond tangible assets, insurers have also had to consider the human element of space travel. Neil Armstrong and Buzz Aldrin’s monumental moon landing in 1969 wasn’t just a historical moment; it was also a landmark for insurance. The astronauts secured their families’ futures through an unconventional method – autographed envelopes, known as ‘Apollo Insurance Covers’, that would be sold in case their mission ended in tragedy.

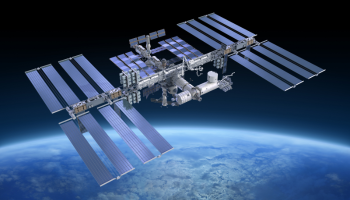

Protecting the Uninsurable: The International Space Station

Arguably the most complex and costly structure ever crafted by humanity, the International Space Station (ISS), strikingly lacks an insurance policy. Despite the inherent risks – space debris, spacecraft dockings, solar flares – the ISS is a unique case where the cost to insure it would be prohibitive, considering the U.S. alone has invested over $75 billion in the project.

Arguably the most complex and costly structure ever crafted by humanity, the International Space Station (ISS), strikingly lacks an insurance policy. Despite the inherent risks – space debris, spacecraft dockings, solar flares – the ISS is a unique case where the cost to insure it would be prohibitive, considering the U.S. alone has invested over $75 billion in the project.

Insuring the entire ISS, with the U.S. alone investing over $75 billion, was deemed impractical during discussions with International Space Brokers in 2001. Instead, liability insurance, protecting NASA from lawsuits in case of ISS debris damage, emerged as an alternative. The idea of insuring “high-value property” on the ISS was also considered. However, due to various challenges, NASA typically operates without insurance, assuming the risk of inevitable losses from its missions.

Despite remaining uninsured, the ISS has instigated crucial discussions about insurance’s role and limitations in space exploration.

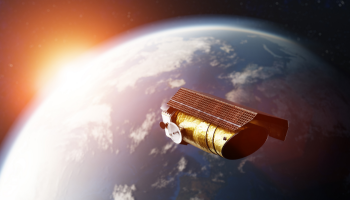

A Turning Point: The Intelsat 507 Satellite

In 1984, we witnessed Lloyd’s of London writing an unparalleled policy – a jaw-dropping $100 million insurance policy for the Intelsat 507 satellite. When the satellite was tragically left in a useless orbit by a malfunctioning rocket engine, Lloyd’s shelled out the full amount, marking the largest ever space insurance claim, and significantly reshaping the space insurance landscape.

In 1984, we witnessed Lloyd’s of London writing an unparalleled policy – a jaw-dropping $100 million insurance policy for the Intelsat 507 satellite. When the satellite was tragically left in a useless orbit by a malfunctioning rocket engine, Lloyd’s shelled out the full amount, marking the largest ever space insurance claim, and significantly reshaping the space insurance landscape.

Dawn of the Space Tourism Era

As the calendar turned to the 21st century, space tourism emerged as a new frontier, birthing yet another extraordinary class of insurance policies. A poignant example of this is Dennis Tito, the first space tourist, who reportedly paid a substantial premium for a $20 million insurance policy to cover his journey to the International Space Station in 2001.

As the calendar turned to the 21st century, space tourism emerged as a new frontier, birthing yet another extraordinary class of insurance policies. A poignant example of this is Dennis Tito, the first space tourist, who reportedly paid a substantial premium for a $20 million insurance policy to cover his journey to the International Space Station in 2001.

Into the Private Spaceflight Era

Fast-forward to the private spaceflight era, with companies like SpaceX and Blue Origin leading the charge, insurance has taken a turn for the gargantuan. The insurance value of the SpaceX Crew Dragon spacecraft is estimated to be in the ballpark of $450 million, showcasing the sky-high stakes of modern space exploration.

Fast-forward to the private spaceflight era, with companies like SpaceX and Blue Origin leading the charge, insurance has taken a turn for the gargantuan. The insurance value of the SpaceX Crew Dragon spacecraft is estimated to be in the ballpark of $450 million, showcasing the sky-high stakes of modern space exploration.

Alien Abduction Insurance

One of the more whimsical entries in this list has to be the alien abduction insurance, first sold by the St. Lawrence Agency in Florida. This peculiar policy, while primarily novelty, underscores the far-reaching imagination of insurance agents and the enduring allure of the unknown in space.

One of the more whimsical entries in this list has to be the alien abduction insurance, first sold by the St. Lawrence Agency in Florida. This peculiar policy, while primarily novelty, underscores the far-reaching imagination of insurance agents and the enduring allure of the unknown in space.

The Hubble Space Telescope

The realm of space-related insurance has seen the inclusion of not just terrestrial or human elements but an array of incredible celestial instruments. One such is the Hubble Space Telescope, an interstellar gem that has irrevocably transformed our view of the cosmos. Insured for an astonishing $10 billion, the Hubble has contributed immeasurably to astronomy.

The realm of space-related insurance has seen the inclusion of not just terrestrial or human elements but an array of incredible celestial instruments. One such is the Hubble Space Telescope, an interstellar gem that has irrevocably transformed our view of the cosmos. Insured for an astonishing $10 billion, the Hubble has contributed immeasurably to astronomy.

Satellites: Sky-High Stakes

Satellites, the sentinels of our space age, have also been subjects of massive insurance premiums. A notable case in point is the Intelsat IS-27, insured for a staggering $400 million. Its mission was tragically cut short when it plunged into the Atlantic, representing one of the heftiest insurance payouts in space history.

Satellites, the sentinels of our space age, have also been subjects of massive insurance premiums. A notable case in point is the Intelsat IS-27, insured for a staggering $400 million. Its mission was tragically cut short when it plunged into the Atlantic, representing one of the heftiest insurance payouts in space history.

Mars Curiosity Rover

The space insurance domain extends its reach to ambitious exploratory missions such as the Mars Rover “Curiosity”. This robotic space explorer, valued and insured at an incredible $2.5 billion, has been surveying the Martian landscape since 2012, bringing priceless insights about the planet’s geological past and potential for life.

The space insurance domain extends its reach to ambitious exploratory missions such as the Mars Rover “Curiosity”. This robotic space explorer, valued and insured at an incredible $2.5 billion, has been surveying the Martian landscape since 2012, bringing priceless insights about the planet’s geological past and potential for life.

SpaceX’s Falcon Heavy: A New Era of Insurance

As we march forward into the era of commercial spaceflight, the scope of space-related insurance continues to evolve. Take, for instance, Elon Musk’s SpaceX Falcon Heavy. Its test mission in 2018, which involved launching a Tesla Roadster into space, represented a thrilling blend of audacity, innovation, and risk. The Tesla, fondly christened ‘Starman’, while its exact insurance value remains undisclosed, is believed to be in the multi-million dollar range.

As we march forward into the era of commercial spaceflight, the scope of space-related insurance continues to evolve. Take, for instance, Elon Musk’s SpaceX Falcon Heavy. Its test mission in 2018, which involved launching a Tesla Roadster into space, represented a thrilling blend of audacity, innovation, and risk. The Tesla, fondly christened ‘Starman’, while its exact insurance value remains undisclosed, is believed to be in the multi-million dollar range.

As we continue our journey into space, managing risk and securing financial protection are shaping the way we progress. Even though we’re just at the beginning of space exploration, every daring move forward takes us one step closer to understanding the universe. And with the ever-evolving space insurance industry backing us, we have the confidence to continue pushing the boundaries, knowing we have the necessary protection to support our bold endeavours.