The Space Sector to Be Bigger Than the Oil Industry

The Rising Value of the Space Industry: Unveiling the Future of the Sector

Innovation, commercialisation and the dawn of the New Space era has meant more than ever before: space is big bucks.

The oil industry currently contributes just under 4% of the global economy. In 2019, the total revenues for the oil and gas drilling sectors came to approximately $3.3 trillion. In less than 30 years, the space sector is estimated to rival that figure and be worth over $3 trillion by 2050.

Space has proven to be one of very few industries where growth has remained resilient through the world-wide recession.

Like the oil industry, the space sector is segmented into ‘upstream’ and ‘downstream’. Within both industries, ‘upstream’ deals with exploration. With oil that’s finding, drilling and extracting, in space it’s exploring the outer regions of the universe and innovating more economic ways to propel ourselves beyond our Earth’s atmosphere.

‘Downstream’ deals with refining and marketing the final product. The ‘final product’ in oil can be anything from plastics to petrochemicals. In the space industry, it’s the refinement and utilisation of data, research and information. Both exploration and refinement drive these industries forward, however only one of them is part of an industry that is ever expanding.

Oil is one of the most important finite resources in the world. When refined, it’s the main energy source used in cars, planes, heating and electricity. Used in plastics, paints, chemicals, tape and so much more, our lives are made much easier with this refined product… now consider – how much has satellite data improved our daily lives? From location data to television channels, weather data to GPS, communications, forestry planning, natural disaster prevention, security and more, our everyday lives use space technology contstantly, and we don’t even think about it.

Space Industry Trends

The media darling of the space industry is space tourism. Enjoying more column space on average than any other part of the sector, everyone from Prince William to Bill Gates have aired their opinion on the value or disadvantages therein, but in reality, this forms a very small part of the industry. It receives such a focus because of the high profile nature of those funding it, primarily Musk, Branson and Bezos: founders of the New Space market.

For the most part, tourism is a means to fund other more humanly beneficial parts of the sector, and as a whole is the driving force for sector growth. It garners attention form some very wealthy investors providing a gateway to other investment opportunities – but it’s not the be-all and end-all of space industry…

The New Space Market

The term ‘New Space’ refers to the increasing commercialisation of space and the privatised funding of organisations with an interest in space and space technologies. The days of governments underwriting space efforts, at least in the US, ended largely in the 1970s. Money from government space agencies like NASA will however continue to play a part through SBIR grants, contracts to small suppliers and direct investments.

For example, SpaceX launched astronauts to the International Space Station last year in a world first, providing the service as a private company, while NASA has previously organized its own astronaut launches.

“One day, space travel will be as everyday as the weather report.” – Jeff Bezos, Blue Origin Founder

Making space travel an everyday occurrence is the goal of Blue Origin Founder Jeff Bezos. Alongside rival Richard Branson, Bezos took to the skies in 2021 in their own supersonic sub-orbital private rockets. It ushered in a new era of space travel in which billionaire-backed companies offer the high-flying excursions to anyone who can afford it.

Passenger flights are without a doubt moving ahead quickly, but with far smaller, non-human payloads, the stakes are smaller and the path easier to tread. The SmallSat launch arena has dozens of companies looking to launch small payloads at reduced prices, alongside easier regulations and insurance costs, the barriers to entry are lower and attractive to new entrepreneurs – and private investors.

The global propulsion market is expected to more than double in size by 2025 to an estimated 14.2 billion. None of this would be possible without the technological advancements necessary to take these objects into Low Earth Orbit (LEO) and beyond. Companies from Scotland to New Zealand are developing and launching rockets that can send small satellites into orbit. Among them are companies such as:

- Firefly Aerospace who are developing a rocket capable of orbiting 2,000lb to LEO*

- Rocket Lab developing an electron rocket to reduce payload costs*

- Vector Launch developing technology to travel to LEO every few days*

Likewise, we see the rise of other companies developing solutions to expedite the progress of the industry.

- NanoRacks have developed a standardised interface between satellites and the rockets they travel on.*

- Made In Space are developing 3D printers to print habitats and components in space utilising materials found on the lunar or asteroid surface.*

- Kymetra have pioneered radio technology to communicate more efficiently and reliably with satellites*

The Urgent Need for Space Data

The demand for data has reached unprecedented levels, with the space industry playing a significant role in meeting this need. Over the past 55 years, satellite ownership and operation have expanded from just 8 countries in 1966 to more than two-thirds of the world’s nations today, as showcased in the video comparing satellite ownership in 1966 and 2020.

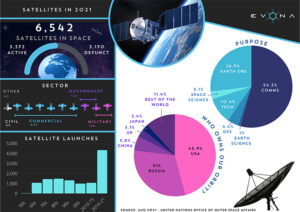

As of Apr 2023, there are over 8,261 satellites orbiting the Earth, and in the last 5 years we’ve sent more satellites up into space than the preceding 32 years. As it stands, the majority of those have been for the commercial sector and their purpose has been largely to better communications. The US, Russia and China are currently the major owners of these satellites, accounting for nearly 3/4 of the equipment in orbit.

As of Apr 2023, there are over 8,261 satellites orbiting the Earth, and in the last 5 years we’ve sent more satellites up into space than the preceding 32 years. As it stands, the majority of those have been for the commercial sector and their purpose has been largely to better communications. The US, Russia and China are currently the major owners of these satellites, accounting for nearly 3/4 of the equipment in orbit.

Satellite miniaturization has fueled this exponential growth, as devices have evolved from bus-sized behemoths to objects as small as a loaf of bread or a mobile phone. This reduction in size has dramatically decreased launch costs, propelling the satellite industry forward.

However, the space industry is not solely defined by satellites and their earthbound observations. The way satellite data is retrieved and processed has also evolved over the decades, and with it the potential roles available.

Ground stations, which connect spacecraft to global telecommunication networks, are continually advancing in technology as the number of satellites in orbit keeps growing. Over the next decade, the volume of data generated by satellites is expected to increase significantly. To manage this surge, companies will need to develop innovative methods for quickly transferring data from space.

Simultaneously supporting multiple communication links will help reduce data transfer costs, making it more affordable for businesses and individuals. Additionally, advancements in efficient propulsion techniques, lighter and smaller payloads, and reusable technology will contribute to the financial viability of space missions.

As these innovations drive down costs, our ability to explore the universe will become more efficient, making access to space increasingly attainable for a broader range of people and organizations.

The Space Race Timeline

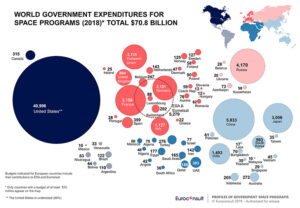

Beyond the long-standing space faring nations of the USA and Russia, China now boasts human spaceflight capabilities and India has taken an active interest in planetary exploration. Countries such as the United Arab Emirates are also investing heavily in space development technologies. It goes to show, you don’t have to live in the USA to have an outstanding career in the space sector. The UAE, where 30% of their GDP is contributed from the oil industry, are now actively looking to diversify into space technology to help shred the hydrocarbon dependence.

If you weren’t already aware of the UAE’s ambitious space plans, you soon will be. Hot on the heels of their Astronaut Programme, which saw the launch of their first Emirati Astronaut to the ISS in 2019, the country launched the Hope probe the following year, a project six-years in the making.

At the same time, the country set up the Middle East’s first space research centre and announced the ‘Arab Space Pioneers’ programme. Overseen by the UAE Space Agency, the programme equips talent with the skills and expertise required to expand career prospects in the growing space sector to actively contribute to the global space community. The programme highlights the importance of investing in the multi-faceted space technology as a major driver of the future knowledge-based economy as they actively look to ease their economic dependence on oil.

In 2020/21, the UK space industry experienced a significant increase in income, rising by 5.1% in real terms to reach £17.5 billion. This growth rate marked the second-fastest annual expansion in the industry over the past seven years. Britain has some serious plans to become a significant global player in the years to come, aiming for a market worth of $100billion by 2030, or 10% of the global market.

With a notable foothold in the satellite manufacturing industries, the UK has invested £40 million to grow its spaceflight capabilities and is funding vertical launches from a spaceport in Scotland and horizontal launches from Spaceport Cornwall. Watch this space.

What Jobs Are There in the Space Industry?

The anticipated growth of the space sector, projected to surpass the oil industry in value, hinges on attracting individuals with transferable skills from various backgrounds, nurturing existing talent, and making the sector more appealing to the future workforce. Space industry staffing specialists, like EVONA, are working diligently to connect these elements and facilitate the sustainable, rapid growth of the sector.

The space industry requires individuals who are passionate about making the world a better place, as they will be working on software-enabled services processing data, developing spacecraft, and collaborating with launch companies to orbit satellites. Opportunities abound in various fields, from studying imagery sent by spacecraft and overseeing data quality systems to advancing propulsion technology, making satellites lighter and smaller, and exploring new satellite service applications.

Contrary to the historical perception of the space industry as a domain reserved for individuals in white coats, your skills are more transferable than you think. Seize the opportunity that many have not yet realized is possible. Careers in marketing, team building, international cooperation, negotiation, design, communication, simulation, and production await those who explore the space sector’s offerings.

As the industry continues to grow, many of us who have never considered a career in space may soon discover that our skills are in high demand by various space corporations. Could the next small step in your career actually be a giant leap? EVONA believes so, and they are already scouting for your next job opportunity in the space industry.

What was once deemed beyond the capabilities of your career are now well within your reach – EVONA can get you there. Launch your career into space and go further than you ever imagined.

Sources:

* Valuation of the Oil industry at 3.3 trillion USD from source Investopedia – According to market research by IBISWorld, a leading business intelligence firm published Feb 2020.

* Analysts at the Bank of America Merrill Lynch predict the sector will surpass $3 trillion in 30 years.

* Q4 2020 Space Investment Quarterly – $141.6B private investment in application technology since 2011.

* United Nations Office of Outer Space Affairs

* EcoConsult 2019